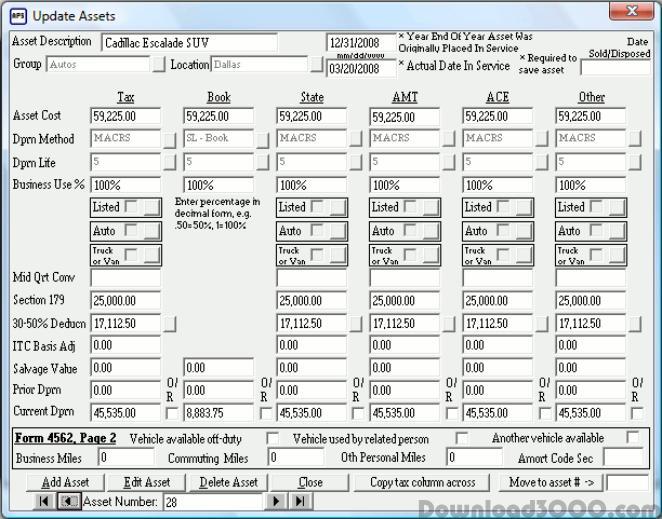

Designed to run on Windows XP, Vista, & Windows 7. It will calculate federal, GAAP, state, AMT, and ACE depreciation for multiple companies, with the unregistered version limitation that open years cannot be rolled forward. Supports most methods, including MACRS, straight line, declining-balance, amortization, and units of production. See http://www.acquest-solutions.com .

Publisher description

AcQuest Pro Depreciation is designed to run on Windows XP, Vista, & Windows 7. The unregistered version will calculate federal, GAAP, state, AMT, and ACE depreciation for multiple companies, with the unregistered version limitation that open years cannot be rolled forward. AcQuest Pro Depreciation uses Microsoft Jet database files to store asset information providing for easy manipulation with programs such as Microsoft Access. Supports most deprecation methods, including MACRS, 150% MACRS, MACRS straight line, ACRS, ordinary straight line, 200% 150% and 125% declining-balance, amortization, and units of production. Prints Form 4562. Context sensitive help.

Related Programs

AcQuest HQ Depreciation for Windows

ASSET DEPRECIATION TOOL FOR EXEL 3.12.10130

Easy to use Asset Register Template for Exel

All-In-One Home Inventory & Asset Manager

IntelliTrack Fixed Asset Tracking Software.

Tracks Fixed Assets and Depreciation.